We Are No Longer In A ‘Rising Tide Lifts All Boats’ Market

It’s going to be tough for apartment operators to maintain occupancies in a slowing economy, although property fundamentals should hold up in 2024 among a few challenges, according to a new report from Yardi Matrix.

Among the challenges are the wave of deliveries, limiting expense growth, rising mortgage rates, and dealing with more expensive and less liquid capital markets.

“We are no longer in a rising-tide lifts-all-boats market,” Yardi Matrix said.

“The traditional property acquisition pipeline will likely remain stalled through most of the year, so near-term opportunities will be concentrated in debt investments and providing capital for property restructurings.”

One big and growing issue will be maturity defaults as loans come due and properties qualify for proceeds that are less than the existing mortgages, according to the report.

On the other hand, the challenges are not insurmountable for owners with a long-term perspective, but they will take skill and expertise to navigate, according to the report.

The higher-for-longer interest rate scenario will bring a market reset with higher acquisition yields, higher financing costs, and lower leverage and values.

“We expect rent growth will be positive in 2024 but diminished by slowing absorption, supply growth, and declining affordability after extraordinary gains in 2021-22,” Yardi Matrix said.

It said rent growth will be found in the Midwest, Northeast, and smaller Southern and Mountain areas where demand remains consistent, and deliveries are subdued.

Strong demand and weak supply growth in markets like New York and Chicago should lead to strong recoveries while the Sun Belt and West markets will see a temporary pause in rent increases. The long-term prospects there remain bullish, however.

The rise in construction financing is putting a lid on new starts and 2024 is expected to be a peak year for deliveries.

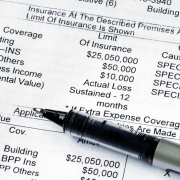

Insurance labor, materials, and maintenance will continue to take a bite out of budgets.

Yardi Matrix believes that activity is likely to remain weak in 2024 “but could rebound later in the year if rate hikes have ended.”

It’s not just that property values are down, but that buyers and sellers can’t agree on how much.

Meanwhile, lenders will continue to be cautious, and borrowers are reluctant to lock in loans at high rates, according to the report.

Source: GlobeSt.