Multifamily Industry Grappling With Surging Insurance Costs

First came supply-chain-fueled higher construction costs. Then came inflation and interest-rate hikes imposed by the Federal Reserve.

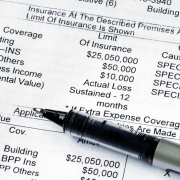

Multifamily property operators are seeing their property insurance premiums rise at a time when the cost to build and finance a commercial real estate project remains elevated, even though most material prices have stabilized.

The recent spike in insurance costs arguably could have the most significant ripple effects within the multifamily industry, as higher rates will likely prompt multifamily landlords to pass those additional costs to tenants. But for income-restricted housing or rent-controlled apartment markets, according to those in the industry, the options to offset those higher costs are more limited.

A recent survey by the National Multifamily Housing Council, a trade group representing rental-housing owners and developers, found property insurance costs have risen 26% on average among respondents during the past year. Hurricane Ian had a tremendous impact on rising premiums, but internal insurance dynamics, industry consolidation, carriers departing some markets and climate change are also to blame for the higher costs.

Beyond the cost of operating an apartment property or portfolio, higher insurance premiums are starting to affect property valuations and disrupt transactions.

Michael Power, a chartered property casualty underwriter at New York-based FHS Risk Management, said during an NMHC webinar that in years past, adequate insurable replacement values weren’t necessarily enforced by the insurance industry. There’s been a monumental change on that front this year, he said, with everyone now required to directly report adequate insurable rebuilding costs for all buildings.

“That is having a huge impact on premiums because it’s driving up the total insurable value of your assets. … It creates a compound effect on premiums,” Power said.

Source: The Business Journals