CRE Carrying Costs Are Nearly As Burdensome As Interest Rates

Little things can add up.

For CRE, that is a range of costs including insurance, utilities, taxes, and other operating expenses. That can burden a property just as easily as higher interest rates.

According to a Moody’s Investor Service report cited by Barron’s, overall expenses for CRE properties are up by more than a third between 2017 and 2022. Insurance is up 73% over the last five years, utilities are 40% more expensive, and property taxes and other operating expenses rose 27% and 29% respectively.

And the lion’s share of these cost burdens, insurance, show little sign of retreating.

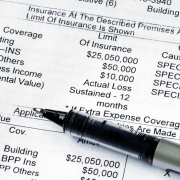

Commercial property insurance premiums hit a record rise of 20.4% in the first quarter of 2023. It’s the first time since 2001 that rates jumped more than 20%. Premiums have been rising by double digits in many markets. Some policy renewals offered half the coverage for that same price. The lack of affordable options is putting needed levels of coverage out of the reach of owners.

Yardi reported that states with increasing climate-related risk, such as Florida and Texas, see their costs rising upwards of 50% and starting to threaten new development and property sales.

Insurance prices are hitting deep into the financial viability of CRE projects, Brett Forman, managing partner at Forman Capital, tells GlobeSt.com.

“I got an email yesterday from a fund I’m personally invested in. They didn’t have claims. Their insurance costs have risen by 70%. That changes the cash flow dynamics. It’s a big line item.”

The problem is that insurance companies are being hit hard by climate change-driven natural disasters. Massive coverage obligations even in a few geographic areas can drive the overall finances of carriers, which then will increase rates across the board.

“People talk about rental growth, but they’re not quick to mention expense growth,” Forman says. “In my mind, you don’t get dollar for dollar credit for the rent growth if expenses have gone up.”

John Vavas, a commercial real estate finance attorney at law firm Polsinelli, points to insurance as well as other carrying costs like taxes. Add increased debt service and it can mean having to find additional equity.

“When you think of a borrower having to bring new equity into a deal, that dilutes them substantially in the valuation,” Vavas adds. “It’s going to affect returns from a cash-on-cash perspective.”

The increase in costs can then affect the ability to get refinanced. Lenders who are watching risk worry that suddenly NOI at a property could drop, making it more difficulty to ensure payments.

“It’s already happening because of interest rates,” Vavas adds. “But you add into some of these other geographic specific issues like [insurance in] California or Florida, and it makes it harder to pencil a deal.”

Source: GlobeSt.