Frivolous Lawsuits Found Not To Be The Cause Of Insurance Premium Surge In Florida

Homeowners’ lawsuits against insurance companies did not cause record losses and rapidly escalating insurance premiums in Florida, according to a new study.

But frivolous litigation has made a bad situation worse, with a disproportionate amount of lawsuits filed in Miami-Dade, Broward and Palm Beach counties. That confirms what the insurance industry has said for years — to a certain extent — the Miami Herald reports.

The Florida Legislature tasked the state’s Office of Insurance Regulation with completing the report. Last year, lawmakers passed legislation making it harder and more expensive for consumers to sue their insurers, in response to the repeated claim that superficial lawsuits were driving the rising cost of premiums.

The report found that litigated claims in the tri-county region in 2022 were six times more expensive than claims that did not result in a lawsuit. The more than 58,000 claims that were litigated in 2022 made up less than 8 percent of claims closed that year, and less than 1 percent of the policies in effect at the time. Insurance companies spent about $580 million on the litigated claims out of nearly $16 billion that Floridians paid in premiums, according to the Herald. That also amounts to less than 1 percent.

State Rep. Erin Grall, a Republican, said that the insurance industry “fabricated their arguments and data over the past few years to manufacture a crisis and push for various legislative reforms,” according to the Herald.

Policyholders were more likely to sue the longer it took for their insurer to close a claim, suggesting that some lawsuits were filed because of insurers’ modi operandi.

Insurance regulators collected the data from insurers under a 2021 bill that Gov. Ron DeSantis approved. Many insurers missed their deadlines or produced insufficient or incorrect information, Florida Insurance Commissioner Mike Yaworsky told the Herald.

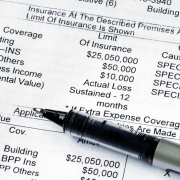

Insurance premiums have doubled, tripled or quadrupled for some owners of commercial and residential real estate in recent years, hampering sales and forcing some to sell their properties at a discount or risk forgoing coverage if they’re able. Some insurers have stopped writing new business, scaled back or gone out of business across Florida.

Source: The Real Deal