3 Multifamily Trends CRE Investors Should Monitor

Multifamily properties are still going strong in the commercial real estate (CRE) sector. But it’s not business as usual. Coming off record growth in 2021, the industry is recalibrating, which creates dynamic investment, valuation and risk environments for multifamily property investors.

Heading into 2023, inflation and rising interest rates prompted forecasts for a slight slowing of growth in the multifamily property sector. Through the first quarter, overall occupancy rates held steady, with a modest increase in vacancy rates to 6.7%, up from 5% one year ago. Rent income is still growing, but month-over-month increases are returning to pre-pandemic norms. Nationwide, demand for multifamily units remains strong, with plenty of inventory in the construction pipeline.

Looking ahead, multifamily properties continue to offer appealing and profitable opportunities for commercial real estate investors. However, today’s evolving market can’t be predicted based on past performance. For investors, keeping a pulse on key demographic, economic and risk-related trends is more important than ever.

1. Demographics and Demand

Demographic trends are favorable for increasing demand. Forty-five million Gen Z-ers, born between 1997 and 2013, will be in their peak years as renters by 2025. At the opposite end of the generational spectrum, an increasing number of Boomers are expected to opt for multifamily properties as they retire and downsize their homes.

Beyond the population numbers, other factors come into play. Inflation and rising interest rates may prompt Gen Z to live at home longer and Boomers to push back their timelines for downsizing from their single-family homes. At the same time, many Millennials are renting longer, having been priced out of the housing market due to a smaller inventory of starter homes and higher levels of personal debt compared to previous generations.

2. Inflation and Valuation

Inflation and higher interest rates have created a challenging near-term capital market environment for the multifamily sector. Capital is available but at a higher cost. With narrowing margins, lenders are taking a more cautious approach and loan-to-value ratios are down. With higher cap rates, the value of a stable multifamily property is lower. Similarly, value depreciation accelerates with slower rent growth and increased operating costs.

Inflation creates uncertainty about how much a property is worth, how much rental income will — or will not — grow and how much operating costs may increase. Digging into the details within a property’s valuation is critical in the current evolving market. An independent third-party valuation analyzes the historical performance of the property, comparable rental rates in the local market and expected operational expenses. The valuation projects the net operating income (NOI) and provides a benchmark of the property’s value over time.

3. Risk and Insurance

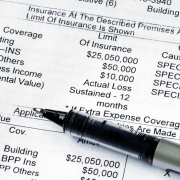

Insurance costs for multifamily properties are also on the rise. Over the past three years, property owners have seen double-digit increases in premium costs. Extreme weather events, such as wildfires, hurricanes and flooding, are a primary reason, with losses exceeding the premium collected. As a result, insurers are reducing their risk exposure in high-risk areas, which means property owners must often seek partial coverage from multiple carriers.

Inflation is also driving increased insurance costs. The cost of construction materials and labor has risen sharply since the start of the pandemic, with multifamily construction costs up 8% in 2023. An up-to-date valuation, which is required by many insurers at renewal, helps property owners to ensure their insurance covers the cost of rebuilding at current prices.

Liability insurance premiums have also increased in recent years, as several carriers exited the excess liability insurance business. Primary liability insurers are mitigating rising costs by increasing premium rates, deductibles and self-insurance limits. Many insurers are managing costs by implementing policy exclusions that may save property owners money in the short term but increase financial risk in the long term.

Insurance advisors can help property owners take a proactive approach to monitoring policy changes, conducting regular property assessments and calculating maximum probable losses in the event of a catastrophic event.

The dedicated commercial real estate team at CBIZ can help you optimize the valuation, insurance and tax strategies for your multifamily investment. Explore more resources and connect with a member of our team today.

This article includes input from John Rimar, Managing Director of CBIZ Valuation Group’s Real Estate Practice, and Greg Cryan, President of Southeast CBIZ Insurance Services, Inc. Their teams provide the initial and ongoing services needed to accurately assess and insure your real estate investments.

Source: CBiz