Multifamily Land Grab Expected To Slow As Interest Rates Rise

Rising interest and insurance rates are projected to slow down South Florida multifamily investments following a year of frenzied buying, according to a recent report from Franklin Street.

Dan Dratch, director of multifamily investment sales at Franklin Street’s Fort Lauderdale office, says real estate investors and developers could hesitate even as apartment rental rates continue to soar and vacancies shrink.

“We have been in such a low interest rate environment, which has been fueling sales in the last couple of years,” Dratch said. “There’s a little bit of uncertainty… [Investors] want to know if it costs more to borrow the money and put more money down, or pay less.”

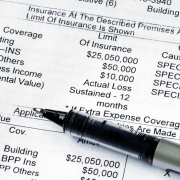

Adding to the uncertainty is rising property insurance rates in the wake of extreme weather events. This hurricane season is expected to be a particularly busy one.

“I know owners who are seeing a 20% to 30% increase on insurance, sometimes higher,” he said. “We have not been hit with a major hurricane [in five years]. If that happens now, it will affect things even further.”

South Florida saw significant rent growth in the first quarter of 2022, according to a Franklin Street report on the multifamily market, with year-over-year rents increasing 16% in Miami-Dade, 20% in Broward, and 23% in Palm Beach County.

At the same time, multifamily buildings were trading at premium rates.

In Miami-Dade County, each apartment unit averaged at $412,612 for new top-of-the-line Class A buildings, $327,394 for Class B buildings, and $207,592 for Class C.

In Broward County, units averaged $419,137 per unit for a Class A, $313,599 for a Class B, and $205,736 for Class C apartment buildings.

In Palm Beach County, apartments averaged at $413,253 per unit for a Class A, $320,410 for a Class B, and $206,812 for a Class C apartments buildings.

There weren’t many available apartment units on the market during the first quarter either.

Palm Beach County had a vacancy rate of just under 1%. Miami-Dade’s dropped to 3.3%. Broward’s vacancy rate increased slightly from the previous quarter to 4.1%, yet the county “also saw more deliveries than the other two counties in the market,” the report stated.

When it came to construction deliveries, Broward County led the tri-county area with 719 apartments added in the first quarter of 2022. In Miami-Dade, 497 new apartment units were added. In Palm Beach, 171 units were completed.

All three counties had fewer apartments finished in the first quarter of 2022 than in each of the quarters of the previous year, the report noted.

In spite of rising interest rates, labor shortages, and supply chain issues, construction of new apartment units are still “above historical averages,” the Franklin Street report noted. In the first quarter, development has commenced on 1,402 multifamily units in Broward, 869 in Miami-Dade, and 976 in Palm Beach County.

The confluence of apartment building transactions, low vacancies, and migration of well-paid remote workers propelled rents in South Florida during the pandemic. Multifamily investors were quick to seize the opportunity and bought up properties at a record pace.

“Most of the owners we were talking to were surprised that they got into a situation where tenants are creating a bidding war for the unit,” Dratch said.

Often, when longtime local renters were given rent increases, they would renew, unable to find cheaper options.

“They are finding it might be worse elsewhere,” Dratch.

While rents are going up everywhere in the United States, the average rents in South Florida are higher than the national average.

According to the National Association of Realtors, the average effective rent — meaning the average rent a landlord receives after deducting expenses such as leasing commissions and tenant improvements — throughout the U.S. was $1,578 a month in the first quarter of 2022, a 12.2% increase over the year before.

Source: SFBJ