CRE Property Insurance Spikes Again In Q2

Multiple severe thunderstorms threw a vicious punch at the commercial real estate industry in the first half of 2023, leaving it with the highest spike in premiums at 18.3%.

The storms accounted for insured losses of around $34 billion in the US alone, which is nearly 70% of global insured natural catastrophe losses in that time and the highest ever insured losses in a six-month period.

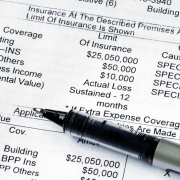

Perhaps not surprisingly then, CRE received the highest increase in insurance premiums among any insurance business lines in the second quarter, according to The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report.

In the report, respondents again pointed to rising property values (as a result of inflation) and natural catastrophe losses as the major contributors to the difficulties with this line.

Furthermore, a report by Swiss Re showed this number reached in just six months, is almost twice as high as the annual average natural catastrophe losses for the past 10 years, $18.4 billion.

CIAB suggested that these losses likely further contributed to carriers pulling back on underwriting commercial property—especially coastal property.

One respondent from a large Southeastern firm said today it is “very difficult to insure in the standard markets.”

Others commented that “property deductibles continued a steady upward march” and that carriers were still “pushing increases in property values,” calling it a lingering effect of inflation.

Reinsurance was another troubling aspect.

“Due to lack of reinsurance support, commercial property capacity has been reduced,” explained one respondent from a large Northeastern firm.

In fact, 80% of respondents reported a decrease in commercial property capacity, and nearly half of them described that decrease as significant.

Another respondent from a large Midwestern firm said that the reinsurance market was so difficult for some companies they had to non-renew property because of capacity issues.

Source: GlobeSt.