Multifamily developer and investor Advenir is paying 76% more for property insurance in 2023 than it did last year. Over the last decade, the company’s rates are up 400%.

“How does that affect us? It affects cash flow, it affects valuations,” Advenir Managing Director Stephen Vecchitto said Wednesday at the Urban Land Institute’s Miami Symposium. “I’ve had the pleasure to learn more about insurance than I’ve ever wanted to know.”

Vecchitto isn’t alone.

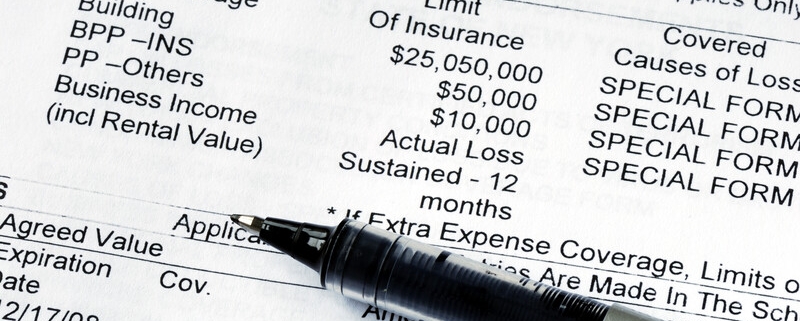

The high cost of property insurance has reached a fever pitch in South Florida, forcing investors and developers to closely examine their coverage and search for creative solutions.

Commercial property rates in South Florida have risen this year by 25% to 50% on average compared to a 10.6% increase nationally, according to an analysis of second-quarter data from the Insurance Information Institute.

For Tim Peterson, the chief investment officer at the luxury property developer The Altman Cos., those increases have started to bite. Fort Lauderdale-based Altman was paying around $75 per unit for insurance in 2003, rising to around $750 per unit in 2019. Today, Altman is paying over $3K per unit for insurance.

“It went from less than 1% of revenue and something you didn’t really talk about to something that everybody’s talking about,” Peterson said at the event, held at the Mandarin Oriental Miami on Brickell Key.

The cost of insurance is now a key factor in the decision-making process across the entire chain of ownership, from the development of a project, to its maintenance and ultimately even the sale. The costs have become such a concern that they’re also coming up in conversations with lenders.

“On the equity side, we used to quickly get to the question of what’s your [preferred] rate and now it’s ‘What insurance do you bring to the table?’” Peterson said. “If an equity investor’s program is better than mine, maybe I pay them for it. The things that we didn’t talk about, we now talk about with investors.”

Altman has also begun to work directly with insurers to convince them to offer lower rates by touting their strong building standards, proactive maintenance and other efforts that would ultimately reduce the cost of any claim, Peterson said. If premiums are still too high, self-insurance is increasingly becoming a popular alternative.

“I haven’t recommended so much self-insurance in my broker career except in 2023,” said Pam Poland, managing director at the property insurance brokerage Marsh, a subsidiary of Marsh McLennan with headquarters in New York.

Vecchitto said while Aventura-based Advenir was also working directly with insurers to understand risk assessments and look for ways to reduce rates, educating providers alone isn’t always enough to bridge the cost gap. In one instance, his firm chose self-insurance after it discovered that it was paying $9.2M for the first $10M worth of insurance in a multilayered policy.

In other cases, the high cost is leading Advenir to walk away from assets.

“Part of our approach is to get more education and how do we do risk transfer to lower that risk,” Vecchitto said. “The second thing we’ve done is we’ve looked at our portfolio, and we’ve said, ‘We’ve got some properties that are costing us more, because they’re older or they’re on the coast,’ and we’re asking how do we trim those back and reinvest.”

Source: Bisnow