Mortgage Rates Keep Escalating

Mortgage Rates Keep Escalating

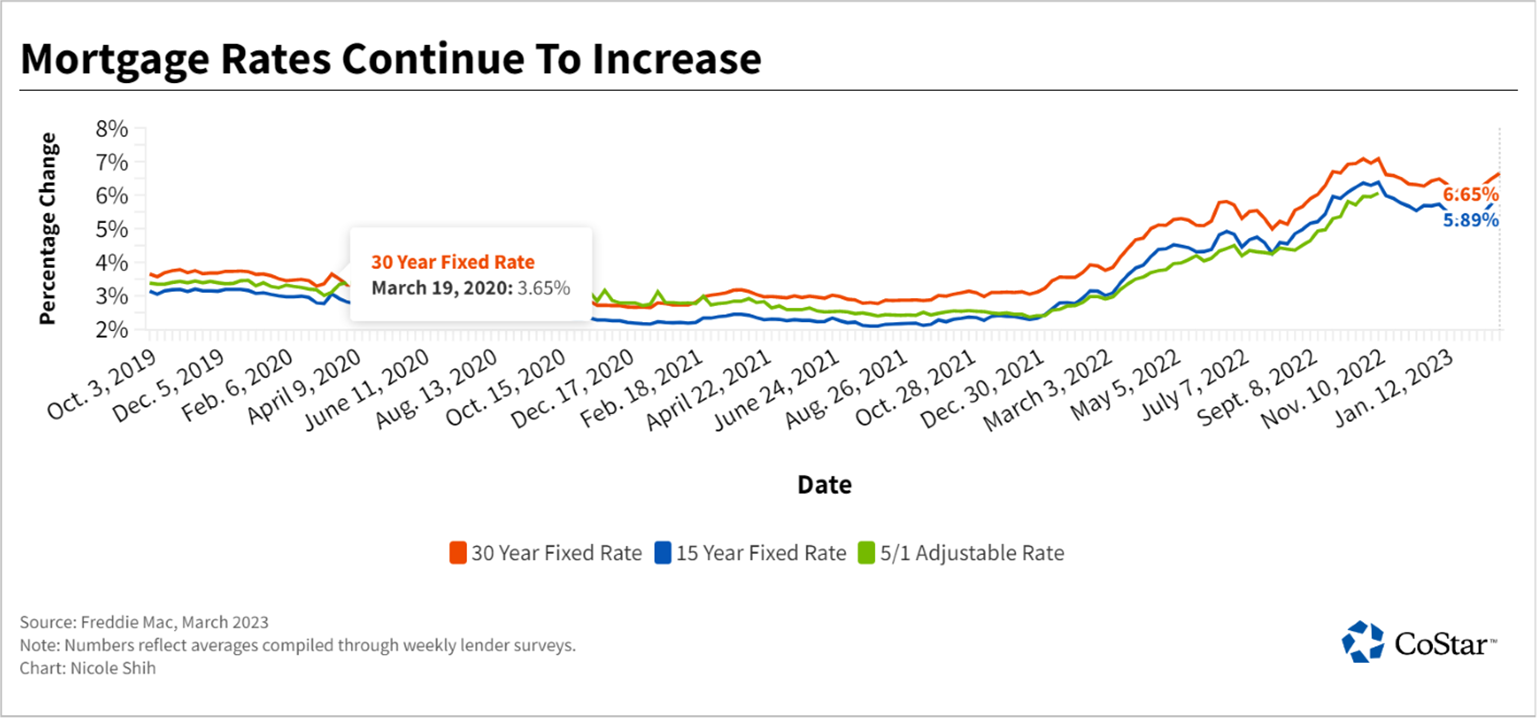

Mortgage rates have kept rising over the past month, with one outlet reporting 30-year loans averaging more than 7% this week for the first time since October.

Mortgage News Daily Thursday reported 30-year, fixed-rate mortgages averaging 7.1%, though a weekly lender survey by government-backed loan agency Freddie Mac put the 30-year loan average at 6.65% for the week ended March 2. Most mortgage rate reports are averages based on national lender surveys, and Freddie Mac has noted there is now a wide range of rate offerings.

“As we started the year, the 30-year, fixed-rate mortgage decreased with expectations of lower economic growth, inflation and a loosening of monetary policy,” Freddie Mac Chief Economist Sam Khater said in a statement Thursday. “However, given sustained economic growth and continued inflation, mortgage rates boomeranged and are inching up toward 7%.”

Freddie Mac noted 30-year, fixed-rate loans averaged 3.76% and 15-year loans averaged 3.01% at the same point of 2022. “Now that rates are moving up, affordability is hindered and making it difficult for potential buyers to act, particularly for repeat buyers with existing mortgages at less than half of current rates,” Khater said.

Annual inflation remains near 40-year highs while declining in recent months to 6.4% in January. The Federal Reserve continues to raise its key lending rate in efforts to bring inflation closer to 2%, sparking rate hikes in many types of consumer and business loans.

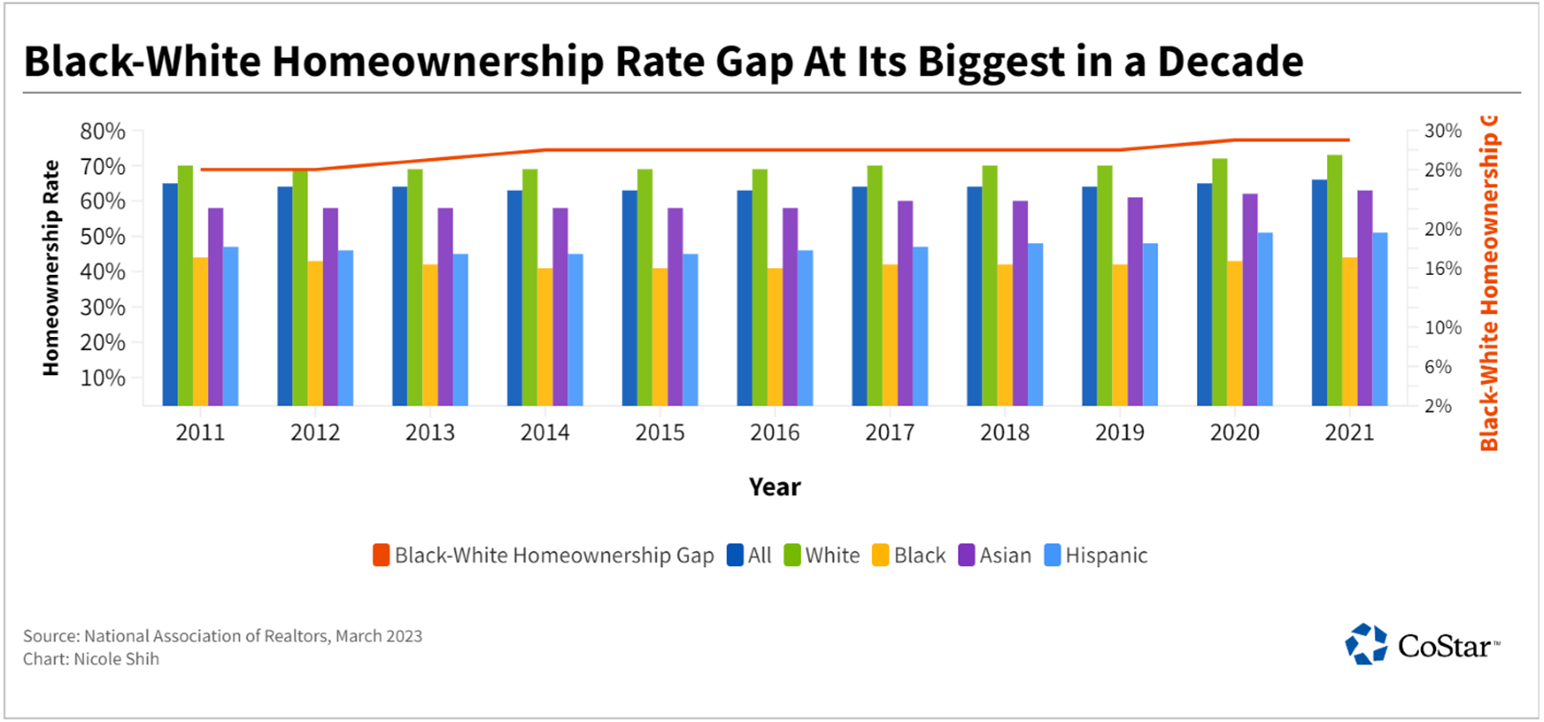

It comes as the gap widened in the home ownership rate between Blacks and whites in the United States.

“As we started the year, the 30-year, fixed-rate mortgage decreased with expectations of lower economic growth, inflation and a loosening of monetary policy,” Freddie Mac Chief Economist Sam Khater said in a statement Thursday. “However, given sustained economic growth and continued inflation, mortgage rates boomeranged and are inching up toward 7%.”

Freddie Mac noted 30-year, fixed-rate loans averaged 3.76% and 15-year loans averaged 3.01% at the same point of 2022. “Now that rates are moving up, affordability is hindered and making it difficult for potential buyers to act, particularly for repeat buyers with existing mortgages at less than half of current rates,” Khater said.

Annual inflation remains near 40-year highs while declining in recent months to 6.4% in January. The Federal Reserve continues to raise its key lending rate in efforts to bring inflation closer to 2%, sparking rate hikes in many types of consumer and business loans.

It comes as the gap widened in the home ownership rate between Blacks and whites in the United States.

Source: CoStar