Florida commercial property owners that have been dealing with escalating insurance costs for years are in for more bad news.

This year, insurance rates in the state are expected to go up by 45 percent to 50 percent, and a doubling of premiums won’t be out of the question, according to a new Yardi Matrix report. While coastal regions are most susceptible to hurricane damage, the increases apply to inland areas as well, the report says.

To many Florida real estate owners and insurance industry insiders, the cause is familiar: Hefty payouts from previous weather-related events left carriers insolvent. Most recently, Hurricane Ian ripped through the state’s Gulf Coast last September, and resulted in more than $50 billion in damage, the report says. Plus, some insurers are averse to covering real estate in the high-risk state, altogether. This leaves less competition for carriers that are left in the market, allowing them to raise rates.

Although skyrocketing premiums are a nationwide issue, states exposed to climate change-related risks will feel the most pain. Aside from Florida, the report points to Texas.

“One Texas community with no claims the prior four years and no increase in coverage received a 17 percent premium increase,” Debra Morgan, managing director at Dallas-based advisory, assurance and tax firm CohnReznick, said in the report.

Florida lawmakers have pushed to tackle the insurance crisis for residential real estate. In a special session last December, they made it harder for homeowners to sue insurers, in an aim to entice carriers to return to the state.

But the crisis necessitates lender reform, industry experts argue in the Yardi Matrix report.

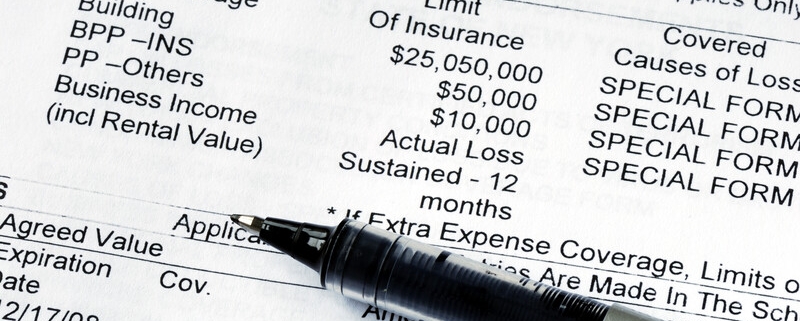

Mortgage lenders often require full wind and flood coverage on commercial real estate in flood zones. Also, many financiers tack on a requirement for coverage of business income losses caused by flooding.

Advocates say that properties are often overinsured to cover extreme losses that rarely occur,” writes Paul Fiorilla, author of the Yardi Matrix report.

Danielle Lombardo, chair of New York-based insurance and risk-management advisory firm Lockton Global Real Estate, said in the report that a potential workaround to lenders’ hefty requirements exists. Instead of requiring full coverage, insurance rates could be based on a “true probable maximum loss methodology,” or the maximum possible loss from a catastrophic event.

For example, lenders might require $40 million in coverage for wind damage, even though modeling would show that the maximum loss for the property would be closer to $10 million.

“The premium for $40 million of coverage might be $3.7 million annually, compared to $1 million for $10 million of coverage,” the report says, citing Lombardo. That is “a margin large enough that it could create a delinquency or distress for some properties.”

Source: The Real Deal